The most important promise made by the proprietors of 5G wireless technology -- the telecommunications service providers, the transmission equipment makers, the antenna manufacturers, and even the server manufacturers -- is this: Once all of 5G's components are fully deployed and operational, you will not need any kind of wire or cable to deliver communications or even entertainment service to your mobile device, to any of your fixed devices (HDTV, security system, smart appliances), or to your automobile. If everything works, 5G would be the optimum solution to the classic "last mile" problem: Delivering complete digital connectivity from the tip of the carrier network to the customer, without drilling another hole through the wall.

Overlooked by London's skyscrapers EE's 5G mobile trial kicks off.

Image: EE

The "if" in that previous sentence remains colossal. The whole point of "Gs" in wireless standards, originally, was to emphasize the ease of transition between one wireless system of delivery and a newer one -- or at least make that transition seem reasonably pain-free. (Not that any transition has ever been a trip to the fair.) 5G entails a set of simultaneous revolutions, all of which would have to go off without a hitch. . . or at least without any further hitches:

- Converged service could lead to unified carriers. In much of the continental US, a consumer's broadband internet provider also has been her cable TV provider. And that relationship is protected by municipally-regulated monopolies. 5G wireless aims to level the playing field here, placing AT&T, Verizon, and a combined T-Mobile/Sprint in competition against Comcast and Charter Communications, both for broadband internet and "cable" television.

- Small cell infrastructure could remake landscapes. To reduce costs for 5G operators, 5G allows for smaller transmitters that consume lower power, but that cover much smaller service areas than typical 4G towers. A carrier will need more of them -- by one estimate, four hundred times more towers than are currently deployed, though conceivably better integrated with the landscape. The expectation is that a 5G small cell could become as common a feature in urban areas as lampposts and graffiti.

- The global technology economy could be reconstructed. Suddenly Scandinavia, home of Finland's Nokia and Sweden's Ericsson, becomes a world power center for telecommunications. And China, whose state-owned China Mobile and state-supported Huawei are jointly responsible for catalyzing 5G architecture, now has one of the most valuable bargaining chips for superpower status it has ever had.

Once complete, the 5G transition plan would constitute an overhaul of communications infrastructure unlike any other in history. Imagine if, at the close of the 19th century, the telegraph industry had come together in a joint decision to implement a staged transition to fax. That's essentially the scale of the shift from 4G to 5G. The real reason for this shift is not so much to get faster as to make the wireless industry sustainable over the long term, as the 4G transmission scheme is approaching unsustainability faster than the industry experts predicted.

Equipment staged by NTT DOCOMO for 5G urban area trials in Japan.

(Image: Ericsson)

5G WIRELESS USE CASES

The revolution, like all others, will be subsidized. The initial costs of these 5G infrastructure improvements may be tremendous, and consumers have already demonstrated their intolerance for rate hikes. So to recover those costs, telcos will need to offer new classes of service to new customer segments, for which 5G has made provisions. Customers have to believe 5G wireless is capable of accomplishing feats that were impossible for 4G.

- Driverless automobiles. For a world in danger of spiraling downwards towards losing one million of its species beginning in 2030, you might think the goal of eliminating drivers from moving vehicles would be somewhat lower on the list. But the autonomous vehicle (AV) use case does expose one of the critical necessities of modern wireless infrastructure: It needs to connect people in motion with the computers they may be relying upon to save lives, with near-zero latency.

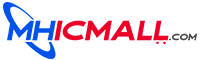

The bandwidth required for a VR application

Qualcomm

- Virtual reality (VR) and augmented reality (AR). For a cloud-based server to provide a believable, real-time sensory environment to a wireless user, as mobile processor maker Qualcomm asserted in a recent presentation, the connection between that server and its user may need to supply as much as 5 gigabits per second of bandwidth. In addition, the compute-intensive nature of an AR workload may actually mandate that such workloads be directed to servers stationed closer to their users, in systems that are relatively unencumbered by similar workloads being processed for other users. In other words, AR and VR may be better suited to small cell deployments anyway.

- Cloud computing. The internet is not just the conduit for content, but the facilitator of connectivity in wide-area networks (WAN). 5G wireless offers the potential for distributing cloud computing services much closer to users than most of Amazon's, Google's, or Microsoft's hyperscale data centers. In so doing, 5G could make telcos into competitors with these cloud providers, particularly for high-intensity, critical workloads. This is the edge computing scenario you may have heard about: Bringing processing power forward, closer to the customer, minimizing latencies caused by distance. If latencies can be eliminated just enough, applications that currently require PCs could be relocated to smaller devices -- perhaps even mobile devices that, unto themselves, have less processing power than the average smartphone.

- internet of Things. In a household with low-latency 5G connectivity, today's so-called "smart devices" that are essentially smartphone-class computers could be replaced with dumb terminals that get their instructions from nearby edge computing systems. Kitchen appliances, climate control systems, and more importantly, health monitors can all be made easier to produce and easier to control. The role played today by IoT hubs, which some manufacturers are producing today to cooperate alongside Wi-Fi routers, may in the future be played by 5G transmitters in the neighborhood, acting as service hubs for all the households in their coverage areas. In addition, machine-to-machine communications (M2M) enables scenarios where devices such as manufacturing robots can coordinate with one another for construction, assembly, and other tasks, under the collective guidance of an M2M hub at the 5G base station.

- Healthcare. The availability of low-latency connectivity in rural areas would revolutionize critical care treatment for individuals nationwide. No longer would patients in small towns be forced to upend their lives and relocate to bigger cities, away from the livelihoods they know and love, just to receive the level of care to which they should be entitled. As recent trials in Mississippi are proving, connectivity at 5G levels enables caregivers in rural and remote areas to receive real-time instruction and support from the finest surgeons in the world, wherever they may be located.

To make the transition feasible in homes and businesses, telcos are looking to move customers into a 5G business track now, even before most true 5G services exist yet. More to the point, they're laying the "foundations" for technology tracks that can more easily be upgraded to 5G, once those 5G services do become available.

"It's not only going to be we humans that are going to be consuming services," remarked Nick Cadwgan, director of IP mobile networking, speaking with ZDNet. "There's going to be an awful lot of software consuming services. If you look at this whole thing about massive machine-type communications [mMTC], in the past it's been primarily the human either talking to a human or, when we have the internet, the human requesting services and experiences from software. Moving forward, we are going to have software as the requester, and that software is going to be talking to software. So the whole dynamic of what services we're going to have to deliver through our networks, is going to change."

WHAT IS 5G REALLY?

If we're being honest (now is always a good time to start), it's incorrect to say that 5G is the fifth generation of global wireless technology. Depending upon whom you ask, and the context of the question, there are really either four or seven generations, and only three sets of global standards.

There was never really an official "1G." There were several attempts at standards for digital wireless cellular transmission, none of which became global. The term "2G" is credited to Finnish engineers to characterize the technological leap forward that their GSM standard represented. However, much of the rest of the world used CDMA instead, which was also "2G." So there was never a single, uncontested 2G.

The global standards community came together with 3G and their 3rd Generation Partnership Project (3GPP). It was with the advent of 3G that the world started counting at the same digit. But even for 4G, there were competing standards, and two major groups of practitioners -- one for WiMAX, the other for the victorious LTE -- vying for global supremacy. The 5G effort has, so far, been successful at keeping the engineers together around the same table, contributing towards a single set of goals.

"The first generation of mobile systems that were launched around 1991 -- popularly known as 2G/GSM -- was really focused on massive mobile device communication," explained Sree Koratala, head of technology and strategy for 5G wireless in North America for communications equipment provider Ericsson, speaking with ZDNet. "Then the next generation of mobile networks, 3G, launched starting in 1998, enabled mobile broadband, feature phones, and browsing. When 4G networks were launched in 2008, smartphones popularized video consumption, and data traffic on mobile networks really exploded.

"All these networks primarily catered towards consumers," Koratala continued. "Now when you look at this next generation of mobile networks, 5G, it is very unlike the previous generation of network. It's truly an inflection point from the consumer to the industry."

WHO DECIDES WHAT AND WHERE 5G CAN BE

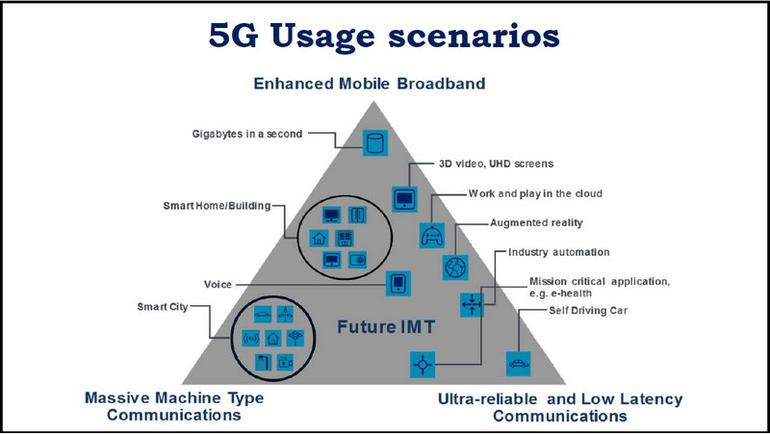

5G wireless is an explicit set of technologies specified by 3GPP as "Release 15" and "Release 16," and recently, has begun a track for "Release 17." 3GPP is an organization consisting of essentially all the world's telecommunications standards bodies who agreed to share the definition of 3G Wireless, and to move on from there to next-generation networks. Today, 3GPP specifies which technologies constitute 5G wireless and, by exclusion, which do not.

The 5G wireless standard aims to be global -- which is the hard part, because each participating country (e.g., China, Russia, South Korea) or amalgamated body of countries (e.g., the EU, the UN) will maintain its own definition of 5G networks, its own concepts of 5G speed, and its own regulations for where 5G transmissions may take place. In November 2018, the US Federal Communications Commission began an auction for exclusive segments of spectrum in the 28 GHz band, soon to be followed by bids in the 24 GHz band, for exclusive use by the winning bidders. The following month, the FCC unanimously approved a plan to make more spectrum in the 37 GHz, 39 GHz, and 47 GHz bands available for the highest-speed communications tier for 5G wireless, called millimeter-wave (mmWave).

Huawei's "1+1" passive + active 5G antenna combination

Huawei

But a good part of the 5G plan involves multiple, simultaneous antennas, some of which utilize spectrum that telcos agree to share with one another (for instance, the 3.5 GHz band in the US) as well as unlicensed spectrum that regulators such as the FCC keep open for everyone at all times (areas between 5 GHz and 7 GHz, and 57 GHz to 71 GHz). Among the technologies inside the 5G umbrella are systems enabling transmitters and receivers to arbitrate access to unused channels in the unlicensed spectrum, much the way 802.11ac Wi-Fi devices do now.

It's vitally important not to confuse gigahertz (GHz, which refers to frequency) with gigabits (Gb, which are quantities of transmitted data). Data throughput speeds for 5G are, as with 4G, measured in gigabits per second (Gbps).

Just because 5G networks will operate at higher frequencies does not make it faster. Those higher frequencies are chosen mainly because they've not been used by anything else yet. And this is where things will get very tricky down the road: Very high-frequency signals do not travel far at all, which is one reason why 5G cellular networks will be smaller, with more transmitters operating within denser cells.

DRIVING FOR HIGHER YIELDS

5G is comprised of several technology projects in both communications and data center architecture, all of which must collectively yield benefits for telcos as well as customers, for any of them to be individually considered successful. The majority of these efforts are in one of three categories:

- Spectral efficiency -- Making more optimal use of multiple frequencies so that greater bandwidths may be extended across further distances from base stations (historically, the main goal of any wireless "G");

- Energy efficiency -- Leveraging whatever technological gains there may be for both transmitters and servers, in order to drastically reduce cooling costs;

- Utilization -- To afford the tremendous communications infrastructure overhaul that 5G may require, telcos may need to create additional revenue generating services such as edge computing and mobile apps hosting, placing them in direct competition with public cloud providers.

SERVICE TIERS

Projection of interrelated 5G service tiers

(Image:International Telecommunications Union)

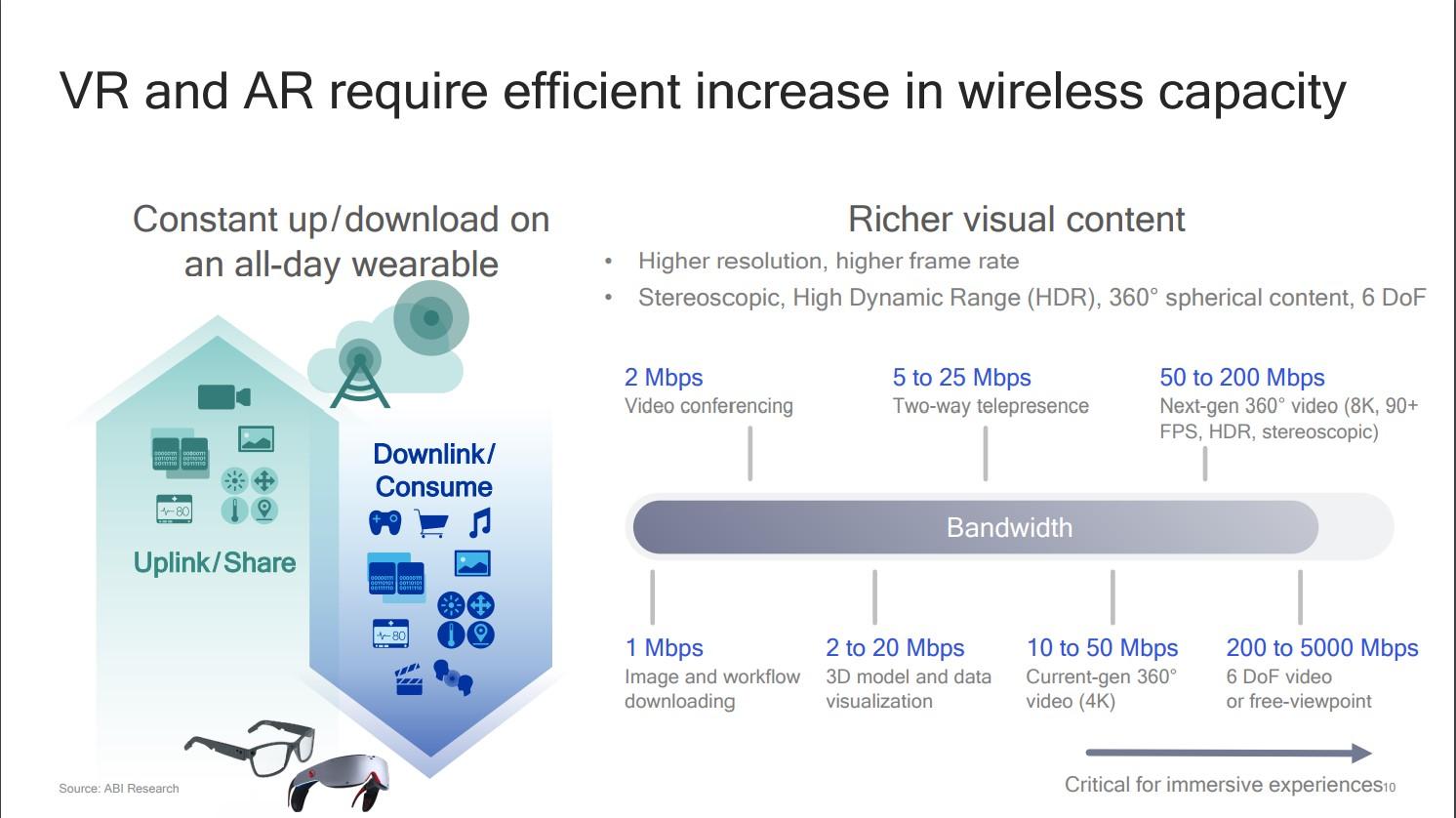

It was during the implementation of 4G that telcos realized they wished they had different grades of infrastructure to support different classes of service. 5G allows for three service grades that may be tuned to the special requirements of their customers' business models:

- Enhanced Mobile Broadband (eMBB) aims to service more densely populated metropolitan centers with downlink speeds approaching 1 Gbps (gigabits-per-second) indoors, and 300 Mbps (megabits-per-second) outdoors. It would accomplish this through the installation of extremely high-frequency millimeter-wave (mmWave)antennas throughout the landscape -- on lampposts, the sides of buildings, the branches of trees, existing electrical towers, and in one novel use case proposed by AT&T, the tops of city busses. Since each of these antennas, in the metro use case, would cover an area probably no larger than a baseball diamond, hundreds, perhaps thousands, of them would be needed to thoroughly service any densely populated downtown area. And since most would not be omnidirectional -- their maximum beam width would only be about 4 degrees -- mmWave antennas would bounce signals off of each other's mirrors, until they eventually reached their intended customer locations. For more suburban and rural areas, eMBB would seek to replace 4G's current LTE system, with a new network of lower-power omnidirectional antennas providing 50 Mbps downlink service.

- Massive Machine Type Communications (mMTC) [PDF] enables the machine-to-machine (M2M) and internet of Things (IoT) applications that a new wave of wireless customers may come to expect from their network, without imposing burdens on the other classes of service. Experts in the M2M and logistics fields have been on record saying that 2G service was perfectly fine for the narrow service bands their signaling devices required, and that later generations actually degraded that service by introducing new sources of latency. MMTC would seek to restore that service level by implementing a compartmentalized service tier for devices needing downlink bandwidth as low as 100 Kbps (kilobits-per-second, right down there with telephone modems) but with latency kept low at around 10 milliseconds (ms).

- Ultra Reliable and Low Latency Communications (URLLC) would address critical needs communications where bandwidth is not quite as important as speed -- specifically, an end-to-end latency of 1 ms or less. This would be the tier that addresses the autonomous vehicle category, where decision time for reaction to a possible accident is almost non-existent. URLLC could actually make 5G competitive with satellite, opening up the possibility -- still in the discussion phase among the telcos -- of 5G replacing GPS for geolocation.

(Image: 3GPP.org)

The full release of the first complete set of 5G standards (officially "Release 15") by 3GPP took place in June 2018. By the end of 2019, the organization expects to declare a supplemental set of 5G standards called "Release 16." That release is slated to include specifications for:

- Vehicle-to-Everything (V2X) communications, which would incorporate low-latency links between moving vehicles (especially those with autonomous driving systems) and cloud data centers, enabling much of the control and maintenance software for moving vehicles to operate from within stationary, staffed, and maintained data centers.

- Satellite access, which may include the ability for satellite transmission to fill in gaps for under-served or geographically remote areas.

- Wireline convergence, which would finally deliver the outcome that AT&T famously warned Congress was absolutely necessary for the communications industry to survive: The phasing out of separate wireline service infrastructure and the deconstruction of the old telephone lines and circuit-switched networks that were the backbone of the Bell System, and other state-sanctioned monopoly service providers of the 20th century.

ARE "5G EVOLUTION" AND OTHER INTERMEDIATE STEPS NECESSARY FOR 5G?

The true purpose of 5G wireless, as you'll see momentarily, is to produce a global business model where expenses are lower and revenue from services is higher, on account of the presence of more and greater services than 4G could provision for. So there is a valid argument, from a marketing standpoint, in favor of a gradual deconstruction of 4G branding. As consumers hear more and more about the onset of 5G, enumeration leaves them feeling more and more like their 4G equipment is old and obsolete.

With so many technologies under the 5G umbrella -- home broadband, office broadband, home television, internet of Things, in-vehicle communication, as well as mobile phone -- there's no guarantee that, when it comes time, any consumer will choose the same provider for each one unless that consumer is willing to sign a contract beforehand. That's why telcos are stepping up their 5G branding efforts now, including rolling out preliminary 4G upgrades with 5G monikers, and re-introducing the whole idea of 5G to consumers as a fuzzy, cloudy, nebulous entity that encapsulates a sci-fi-like ideal of the future.

"The general purpose technology for the Fourth Industrial Revolution is actually the ambiguous sort of connectivity that 5G can bring," admitted Verizon CEO Hans Vestberg, in no less conspicuous an arena than the keynote address of CES 2019.

Verizon CEO Hans Vestberg explains "5G for All" to attendees at CES 2019.

[Photo courtesy Verizon]

"So what is 5G? 5G is a promise," Vestberg continued, "of so much more than we've ever seen in any wireless technology. From the beginning, we had the 1G, the 2G, the 3G, and the 4G. They were sort of leaps of differences, when it comes to speed and throughput. When we think about 5G, we think about 10 gigabits per second throughput, we talk about 10x battery life, we think about 1000 times more data volumes in the networks. It's just radically different. I would say it's a quantum leap compared to 4G."

The first wave of 5G-branded services are effectively 4G, or 4G extensions, that place consumers on the right track for future 5G upgrades, thus guaranteeing the revenue sources that 5G will require to be successful, or if only to just break even.

- Verizon's "First on 5G" began with the October 2018 rollout of what's being called 5G Home -- a broadband Wi-Fi service that bundles wireless phone with no-longer-cable TV service, for a price that, after short-term discounts, could rise to as much as $120 per month. In the test cities where it was first deployed, 5G Home may utilize wireless spectrum that is indeed being earmarked for 5G. Yet it involved a grade of equipment only capable of 300 megabits-per-second (Mbps) throughput, that would eventually need to be upgraded to 1 gigabit-per-second (Gbps) for it to qualify as 5G technology. In January 2019, Verizon CEO Hans Vestberg indicated to financial analysts that 5G Home rollout may remain limited to the initial test area for some time to come, as the company awaits new standards for customer premise (CP) equipment, probably as part of 3GPP's Release 16. This after it seemed clear to observers that Verizon was willing to continue rolling out intermediate equipment with a "5G" brand until that time.

- AT&T's "5G Evolution" began in December 2018 with the sudden, unanticipated appearance of a "5G E" icon in the notifications area of 4G customers' phones. The icon appears if the phone is presently being serviced by a 4G LTE transmitter capable of being upgraded to 5G specifications. Those transmitters may have begun using frequencies over and above those originally reserved for 4G LTE, in addition to those already being used, for greater multiplexing and presumably greater bandwidth, although phones may not necessarily be equipped to receive these extra frequencies, even if they show the "5G E" icon.

- AT&T's "5G+" also began in December 2018, and refers to a mobile hotspot service that uses an early version (some would say "prototype") of the very-high-speed mmWave technology that is being earmarked for 5G, in addition to existing 4G LTE. The hotspot device itself (Netgear's Nighthawk 5G Mobile Hotspot) will be sold separately by AT&T for $499, while it offers the service for $70 per month for the first 15 GB. With a theoretical peak throughput of 300 Mbps, it's conceivable that this device's initial bandwidth allocation could be completely burned through in less than seven minutes' time.

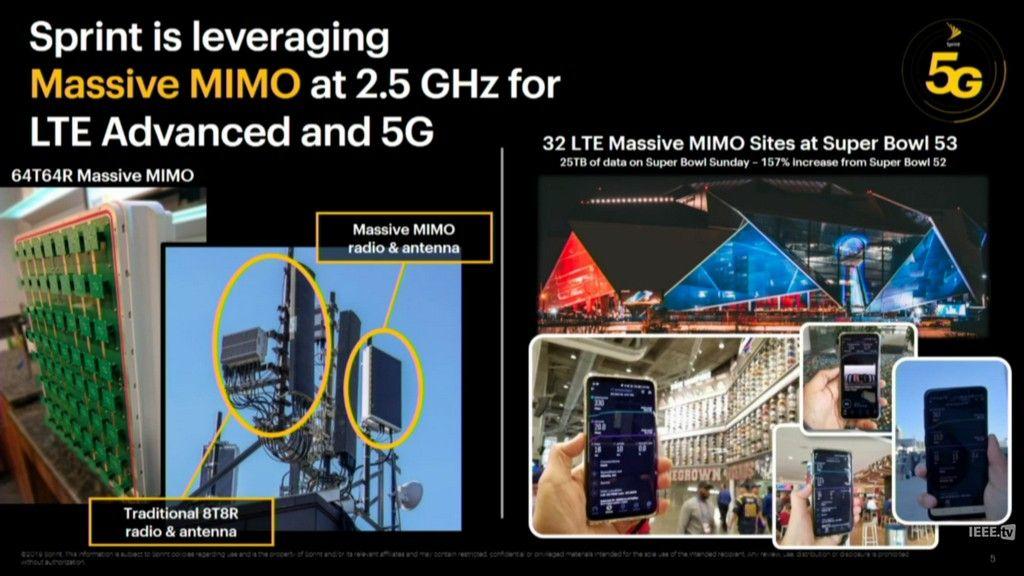

Sprint

- Sprint has plans to roll out its 5G-branded service on May 31, 2019 in Atlanta, Chicago, Dallas, and Kansas City in May 2019, with plans to add five more U.S. cities in June. Its first 5G smartphone -- the LG model V50 ThinQ -- premiered in May as well. The initial skepticism generated by AT&T's and Verizon's rollouts have led many to conclude Sprint's can't be "real 5G" as well. It will not include mmWave service (which AT&T has championed), opting instead to deploy so-called mid-band frequencies using MIMO multiple antenna technology. Sprint CTO Dr. John Saw called this deployment "Split Mode," saying, "Because we have 160 MHz of 2.5 GHz spectrum in our top 100 markets, we can afford to support both LTE and 5G simultaneously using the same 2.5 GHz band." Some say "Split Mode" isn't really 5G either, although Saw presented this system at a conference heavily attended by 3GPP, and no one appeared to object (at least not publicly).

- T-Mobile has yet to complete its merger with Sprint, mostly for regulatory reasons. In the meantime, the company has said it plans to launch what it characterizes as "true 5G service" to select cities, very soon after the merger is allowed to go through. In a statement, the company says it will need access to the mid-range of 5G spectrum currently delegated for Sprint, in addition to the low- and high-range spectrum T-Mobile currently holds, to deliver the first wave of its services. It's the combination of these two companies' respective spectrum that is the key to both being able to offer a high-speed 5G tier using Massive MIMO that they both feel would be competitive against mmWave. T-Mobile CEO John Legere has blasted AT&T's 5G E initiative, taking to Twitter last March to call it "a flat-out lie.

HOW GLOBAL WARMING MADE 5G AN URGENT NECESSITY

In May 2017, AT&T President of Technology Operations Bill Hogg declared the existing wireless business model for cell tower rental, operation, and maintenance "unsustainable." Some months earlier, a J. P. Morgan analyst characterized the then-business model for wireless providers in Southeast Asia as unsustainable, warning that the then-current system has rendered it impossible for carriers to keep up with customer demand. And as research firm McKinsey & Company asserted in a January 2018 report, the growth path for Japan's existing wireless infrastructure is becoming "unsustainable," rendering 5G for that country "a necessity."

One senses a theme.

The world's telcos need a different, far less constrained, business model than what 4G has left them with. The only way they can accomplish this is with an infrastructure that generates radically lower costs than the current scenario, particularly for maintaining, and mainly cooling, their base station equipment.

Read also: Stingray spying: 5G will protect you against surveillance

Cooling and the costs associated with facilitating and managing cooling equipment, according to studies from analysts and telcos worldwide, account for more than half of telcos' total expenses for operating their wireless networks. Global warming (which, from the perspective of meteorological instrumentation, is indisputable) is a direct contributor to compound annual increases in wireless network costs. Ironically, as this 2017 study by China's National Science Foundation asserts, the act of cooling 4G LTE equipment alone may contribute as much as 2% to the entire global warming problem.

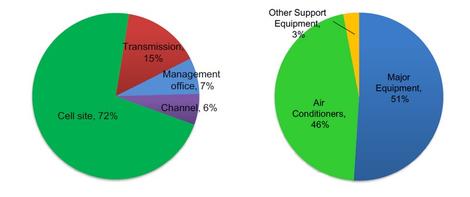

THE WORLD'S BIGGEST EXAMPLE

China Mobile's breakdown of its annual capital and operational expenditures for maintaining one 3G base station.

(Image: China Mobile)

The 2013 edition of a study by China Mobile, that country's state-licensed service provider, examined the high costs of maintaining energy-inefficient equipment in its 3G wireless network, which happens to be the largest on the planet in both territory and customers served. In 2012, CM estimated its network had consumed 14 billion kilowatt-hours (kWh) of electricity annually. As much as 46% of the electricity consumed by each base station, it estimated, was devoted to air conditioning.

That study proposed a new method of constructing, deploying, and managing network base stations. Called Cloud architecture RAN (C-RAN), it's a method of building, distributing, and maintaining transmitter antennas that history will record as having triggered the entire 5G movement.

Read also: Samsung and KDDI complete 5G trial in baseball stadium

One of the hallmarks of C-RAN cell site architecture is the total elimination of the on-site base band unit (BBU) processors, which were typically co-located with the site's radio head. That functionality is instead virtualized and moved to a centralized cloud platform, for which multiple BBUs' control systems share tenancy, in what's called the baseband pool. The cloud data center is powered and cooled independently, and linked to each of the base stations by no greater than 40km of fiber optic cable.

An Ericsson 5G transmitter used in NTT DOCOMO's Japan trials.

(Image: Ericsson)

Moving BBU processing to the cloud eliminates an entire base transmission system (BTS) equipment room from the base station (BS). It also completely abolishes the principal source of heat generation inside the BS, making it feasible for much, if not all, of the remaining equipment to be cooled passively -- literally, by exposure to the open air. The configuration of that equipment could then be optimized, like the 5G trial transmitter shown above, constructed by Ericsson for Japan's NTT DOCOMO. The goal for this optimization is to reduce a single site's power consumption by over 75%.

What's more, it takes less money to rent the site for a smaller base station than for a large one. Granted, China may have a unique concept of the real estate market compared to other countries. Nevertheless, China Mobile's figures show that rental fees with C-RAN were reduced by over 71%, contributing to a total operational expenditure (OpEx) reduction for the entire base station site of 53%.

Keep in mind, though, that China Mobile's figures pertained to deploying and maintaining 3G equipment, not 5G. But the new standards for transmission and network access, called 5G New Radio (5G NR), are being designed with C-RAN ideals in mind, so that the equipment never generates enough heat to trip that wire, requiring OpEx to effectively quadruple.

THE NEW CLOUD AT THE NEW EDGE

It would appear a lot of the success of 5G rests upon this new class of cloud data centers, into which the functionality of today's baseband units would move. As of now, there is still considerable uncertainty as to where this centralized RAN controller would reside. There are competing definitions.

Some have taken a good look at the emerging crop of edge data centers sprouting adjacent to today's cell towers, and are suggesting that the new Service Oriented Core (SOC) could be distributed across those locations. Yet skeptics are wondering, why bother with the elimination of the BTS station in the first place, if the SOC would only put it back? Alternately, a separate SOC station could be established that services dozens of towers simultaneously. The problem there, obviously, is that such a station would be a full-fledged data center in itself, which would have real estate and cooling issues of its own.

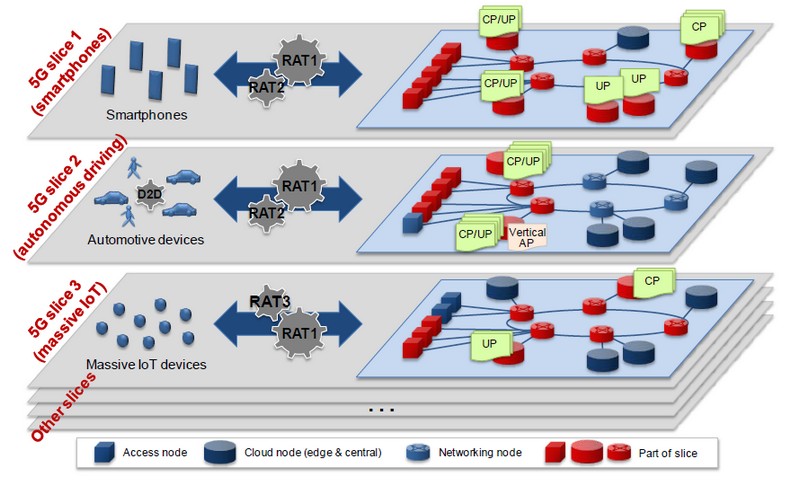

Either option might be more palatable, some engineers believe, if the servers operating there could delegate computing infrastructure among internal operations and special customer services -- edge computing services that could compete with cloud providers such as Amazon and Microsoft Azure, by leveraging much lower latency. The ability to do so is entirely dependent upon a concept called network slicing. This is the subdivision of physical infrastructure into virtual platforms, using a technique perfected by telecommunications companies called network functions virtualization (NFV).

Also: Microsoft Azure: Everything you need to know about Redmond's cloud service

THE DICEY SUBJECT OF SLICING

One scenario mobile operators envision for 5G network slicing.

(Image: Next Generation Mobile Networks Alliance)

Exactly what routes these network slices would take through the infrastructure is completely up in the air. T-Mobile and others have suggested slices could divide classes of internal network functions -- for instance, dividing eMBB from mMTC from URLLC. Others, such as the members of the Next Generation Mobile Networks Alliance (NGMN), suggest that slices could effectively partition networks in such a way (as suggested by the NGMN diagram above) that different classes of user equipment, utilizing their respective sets of radio access technologies (RAT), would perceive quite different infrastructure configurations, even though they'd be accessing resources from the same pools.

Another suggestion being made by some of the industry's main customers, at 5G industry conferences, is that telcos offer the premium option of slicing their network by individual customer. This would give customers willing to invest heavily in edge computing services more direct access to the fiber optic fabric that supports the infrastructure, potentially giving a telco willing to provide such a service a competitive advantage over a colocation provider, even one with facilities adjacent to a "carrier hotel."

But depending upon whom one asks, slicing networks by customer may actually be impossible. There are diametrically split viewpoints on the subject of whether slicing could congregate telco functions and customer functions together on the same cloud. Some have suggested such a convergence is vitally necessary for 5G to fulfill the value proposition embodied in C-RAN. Architects of the cloud platforms seeking to play a central role in the SOC, such as OpenStack and CORD, argue that this convergence is already happening, and the whole point of the architecture in the first place.

AT&T has gone so far as to suggest the argument is moot and the discussion is actually closed: Both classes of functions have already been physically separated, not virtually sliced, in the 5G specifications, its engineers assert. In a January 2019 statement, the company said it has already begun deployments of what it calls Multi-access Edge Compute (MEC) services with select customers, in some cases using existing 4G LTE connectivity. "The data that runs through AT&T MEC," the statement reads in part, "can be routed to their cloud or stay within an enterprise's private environment to help increase security."

Yet AT&T may yet wish it had not attempted to close the issue so soon. 5G's allowance for smaller towers that cost less and cover more limited areas is prompting ordinary enterprises to seek their respective governments' permission to become their own telecommunications providers, with their own towers and base stations serving their own facilities German manufacturing giant Robert Bosch GmbH launched a partnership last March with Qualcomm, enabling the company to apply for and receive dedicated spectrum from German authorities. The move will enable Bosch itself -- which was evidently aggravated with the pace of the network slicing argument -- to supply 5G wireless service to its own factories.

If other major enterprises with large campuses follow Bosch's lead, the principal customers for network slicing services may exit the market before it even begins.

THE EMERGENCE OF FIXED WIRELESS

Despite what you may have read elsewhere, 5G is not exclusively a mobile wireless standard. Fixed wireless data connectivity will be an option, especially in dense metropolitan areas. Such a system would enable gigabit-per-second or greater bandwidth, through a dazzling, perhaps bewildering, new array of microwave relay antennas.

Ericsson's own forecasts of wireless connectivity have been known to fool people. In June 2017, its annual Mobility Report estimated that mobile data traffic would grow at an average compound annual growth rate of 42% through 2022, having grown eightfold by the end of that period. "By the end of the forecast period," stated Ericsson, "more than 90% of mobile data traffic will come from smartphones."

That forecast generated a truckload of headlines. A half-billion 5G mobile subscriptions are expected worldwide by 2022, reported ZDNet's Corinne Reichert. Ericsson's updated report, published last November, doubled that forecast number for 2023, adding that 5G access would reach one-fifth of the world's population by the end of that year.

The keyword in the above paragraphs is "mobile." Up to now, all the "Gs" have pertained to the wireless access technology we've historically perceived as synonymous with mobility. For 5G to be truly successful, Ericsson's Koratala told us, it will need to open up access to a broader range of devices, many of which are actually not the least bit mobile.

THE NOT-SO-MOBILE PROPOSITION

"These connections are expected to be going into devices in factories, transportation, and the grid," said Koratala. "So the range of applications means a huge diversification of performance and requirements for communication. Then there are some use cases that might be demanding a 5x improvement in latency, a 100x or 1000x data volume, as well as [extending] battery life. So when you look at that set of requirements, it's very clear that it is not a single use case. It really becomes an enabler for a wide variety of use cases, that will have different requirements to be met to make them viable."

The key mission of mMTC is to service wireless devices that don't move. Its transmission scheme will be tuned for very high density -- for situations like factory floors where thousands of individual mechanical elements are sending operational data, simultaneously, to an off-site location for instant analytics.

Viewed in this light, the prediction that nine-tenths of mobile data will be consumed by the largest class of mobile devices, seems about as spot-on as a forecast that rain will continue to be wet. What is completely unpredictable at this point is whether a fixed wireless use case will be competitive in an environment where wired broadband is also undergoing a revolution.

EXCHANGING YESTERDAY'S NEW TECHNOLOGY FOR TODAY'S

You will hear from many sources that 5G is not about what anything is, but rather what it enables you to do. No, it isn't. 5G is about the things in which the telecom industry, and to a growing extent the data center networking industry, must invest in order to produce the latest editions of platforms such as V2X and mMTC, so that it can start earning revenue from those services. 5G is all about what it is.

If you end up watching smoothly streaming 4K video on a new class of smartphone, allowing yourself to be ferried between cities in an otherwise unoccupied vehicle, or participate in a virtual, real-time football tournament with a few dozen goggle-wearers scattered throughout the planet, then you will be fulfilling the hopes of telco engineers who hope to make 5G viable. The truth is, none of these consumer technologies are the real reason 5G is being engineered. Indeed, they are the side benefits.

THE BIG GAMBLE

Three experimental AT&T cell tower designs for desert deployment. (Yes, they're right in front of you.)

(Image: AT&T)

5G is a collective bargain between the telecommunications industry and society. To allow for anything close to evenly distributed coverage over a metropolitan area, the base stations containing the transmitters and receivers (the "cells") must be smaller, much lower in power, and much greater in number than they are today. Essentially, the new cell towers must co-exist with the environment. An outdoor photograph taken in any direction will be just as likely to include a 5G tower as not. (The example above, provided by AT&T, includes three.)

It would not be unprecedented in history. We've borne telephone and electric poles through our neighborhoods and, not all that long ago, willingly installed TV aerials the size of kites on our chimneys. Some of us still use their old mounting posts for our satellite dishes. In exchange for the hopefully minor blemish on our landscapes that 5G may bring, many would wave a cheerful good-bye to dead spots.

All these things must happen, and in relatively quick succession, in order for telcos to afford the infrastructural overhaul they now have no choice but to make.